As an ecommerce seller, these questions must have crossed your mind at least once. At what point do imports traveling through borders become a seller’s property instead of being the buyer’s property? At what point does the ownership change hands? Who bears the risk of loss, theft, and damage in transit?

I like your curiosity. It goes on to show that you can think critically, which is a prerequisite to be a successful ecommerce business owner. Anywho, Incoterms can be confusing, especially if you don’t know which one to use.

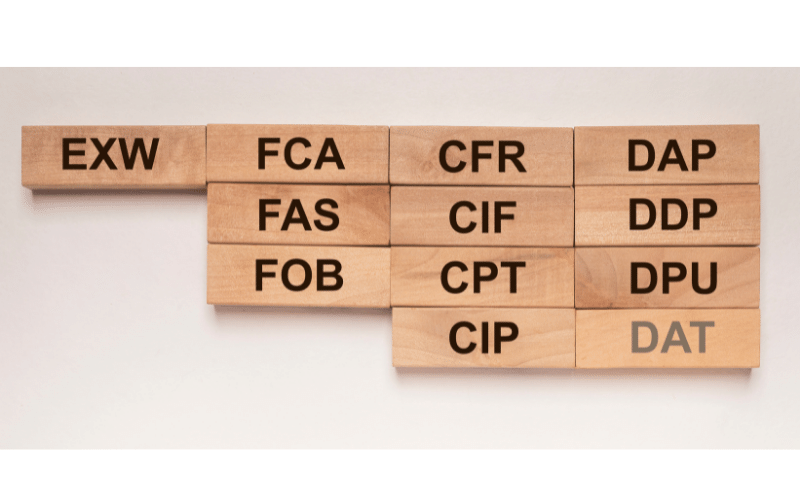

Depending on where the goods are located along the supply chain, the International Commerce Terms (Incoterms) assign responsibility and liability to certain parties.

Here is a breakdown of three of the most common incoterms, FOB vs. CIF vs. DDP. We’ll take a look at the pros and cons of each of them and determine which one is the best incoterm for your ecommerce business. If you’re an Amazon FBA ecommerce business owner, you don’t want to miss out on this guide about the best trade terms for Alibaba and IndiaMart.

Let’s take a look at the differences between FOB, CIF, and DDP and help you choose the best one for your business?

What is a FOB? Why You Should And Shouldn’t Use A FOB

FOB Explained: What is FOB?

FOB stands for “free on board” which is also called “freight on board.” There are two components to FOB terms: Origin or Destination and Collect or Prepaid.

When the goods are sold FOB Origin terms, the buyer becomes the owner of the goods at the point of origin of the shipment. The buyer assumes responsibility for the goods the moment the shipper loads them onto the freight carrier.

On the other hand, when goods are shipped on FOB destination terms, the buyer acquires ownership of the goods at the point of delivery, which means the shipper owns the product while it is in transit and until it reaches the destination in the hands of the buyer.

An origin FOB transaction, where the buyer takes responsibility for goods the moment they leave the seller’s hands, is much more common. As the name implies, freight collection means the buyer is responsible for the freight charges. When the seller prepays the freight charges, the buyer does not have to pay them. This is called freight prepaid.

In the import world, FOB usually refers to FOB Origin, Freight Collect. After the goods have left their origin point, ownership and responsibility for them fall to the buyer.

Here is how the FOB process works:

- Upon receiving the order from the buyer, the seller loads the freight vessel of his choice.

- Clearance of goods for export is performed by the seller at the port of dispatch.

- As soon as the warehouse receives and inspects the package, the title of goods passes to the buyer.

- If costs and risks associated with freight transport need to be insured, the buyer is responsible for them throughout the transit period.

Why You Should Use FOB And Why You Shouldn’t Use FOB Incoterm

Why FOB?

Buyers generally prefer the FOB method due to its cost-effectiveness. CIF requires buyers to pay a high fee to their sellers. Furthermore, because the buyer is able to choose their own freight forwarder, they have more control over the freight schedule and cost. As the owner and responsible party, if anything happens to the goods, they have better access to information and can solve concerns more effectively.

FOB is also popular with sellers because the seller transfers the responsibility for the goods once they are sold. As soon as the products are dispatched from the warehouse, sellers can mark the sale as “complete” and don’t have to worry about additional costs.

Why Not FOB?

A FOB agreement would not be recommended for new importers since buyers would retain more responsibility for their goods while in transit. People who are new to overseas shipping might make mistakes that have severe repercussions if they don’t understand the complexities.

If you’re a new-ish importer and want to learn how you can start your ecommerce business, then this guide is the one you should read.

Buyers who are unfamiliar with importation might choose a CIF contract until they learn more about the whole process. On that note, let’s take a look at what a CIF contract is.

What is a CIF? Why You Should And Shouldn’t Use A CIF Incoterm

CIF Explained: What is CIF?

CIF stands for “cost insurance and freight.” In CIF, The seller usually retains primary ownership until delivery. This means that until the goods reach their destination with the buyer, the seller is responsible for risk and insurance costs. Once the goods have passed the boat’s railing at their destination, ownership and liability shift from the seller to the buyer.

This method of shipping places the sellers in charge of everything involved. In addition, they are the ones who are responsible for providing all the necessary customs documents, paying all associated insurance costs, and ensuring the goods are delivered safely to the buyer at the destination port.

Why You Should Use CIF And Why You Shouldn’t Use CIF

Why CIF?

If you’re a buyer, using CIF may be more convenient for you. Risk, claims, or issues with freight become a part of the seller’s responsibilities during transportation. A new importer usually lacks knowledge about the complexities of overseas shipping and import. For them, they find CIF especially useful. CIF is preferred by many importers when importing a small batch of cargo since the cost of insurance can be lower for small volumes than the processing fees charged by sellers.

Shipping CIF may be preferable for sellers since they will generate a higher margin. However, sellers are exposed to additional risks because of the ownership of goods during transit.

Why Not CIF?

CIF agreements tend to be more expensive for buyers than FOB agreements. Shipping and insurance costs are often included in invoices sent by sellers to buyers. Some might even add on extra charges to maximize their profits. This approach results in buyers paying more for shipping than if they were paying for shipping FOB.

Buyers are, in essence, paying for convenience. Furthermore, buyers using CIF are essentially giving up control of their shipments to the sellers. Since the buyer is not necessarily the owner of the items, it also becomes challenging for the buyer to obtain accurate shipping information for a CIF shipment. As most of the responsibility is with the seller, a buyer may face severe penalties and fines for any delays to shipments.

It is common in the US and internationally to assume that businesses will reduce costs if they make the vendor pay for transportation costs and duty costs associated with each shipment of cargo imported from foreign nations. The truth is that there are hidden costs associated with importation.

What is a DDP? Why You Should And Shouldn’t Use A DDP Incoterm

DDP Explained: What is DDP?

DDP stands for Delivery Duty Paid. In a DDP situation, a seller is responsible for arranging carriage and delivery of the goods to the destination of the shipment, ensuring that they are cleared for import and that all applicable taxes and duties are paid (e.g., GST, TVA).

When the goods are ready for unloading from the arriving means of transportation and made available to the buyer, the risk is transferred to the buyer. DDP is very similar to CIF and is almost identical.

For sellers, DDP can pose several difficulties because of complex and bureaucratic import clearance procedures in some countries. It is therefore beneficial for the buyer who has the local knowledge to handle some parts of the deal.

Why DDP?

DDP is convenient for the buyer and can even be helpful for new first-time importers. However, it may come at a price premium as most international sellers will levy a heft charge for a DDP term or bump up the price.

Why Not DDP?

DDP, similar to CIF, gives very little control and ownership to the buyer, which is beneficial to have in case things go south.

What Is The Best Incoterm Trade Term For Alibaba And FBA Sellers?

DDP is the best trade term for Alibaba and FBA sellers who are importing for the first time.

Due to the fact that DDP or CIF Incoterms requires that the seller ship the item at their own cost to the final destination, DDP and CIF tend to be very popular with first-time buyers who are sourcing from Alibaba and selling on FBA.

Veteran Amazon FBA sellers know that Amazon fulfillment centers are their final destination.

If the buyer arranges shipping, they will usually end up paying more when using DDP compared to FOB or CIF. However, the DDP model allows the buyer not to be concerned with transportation and other problems.

Closing Thoughts

There are a total of 11 incoterms outlined by the international chamber of commerce. In this article, we’ve briefly touched on 3 of them. The best incoterm for you would depend on your level of experience and expertise as well as the amount you wish to take. If you’re a seasoned importer, FOB could be an excellent option for you. However, if you’re a first-time importer, we suggest you go for a CIF.

Do let us know your thoughts in the comments and what you’d like to read next.

1 thought on “Everything You Need To Know About CIF, DDP, and FOB – Which one should you choose?”